This was always going to be an unusual budget. More eagerly anticipated than usual, it seemed that everyone was waiting to see what would happen. That said there were few leaks with some measures announced ahead of time, so we had a little warning of the headline policies.

We’ve split this blog into two separate parts, firstly covering the more immediate changes due to the coronavirus and the measures in place as we come out of lockdown initially. And then moving on to the other changes in taxes going forward.

Coronavirus Measures

CJRS Furlough scheme extended to September 2021

The furlough scheme has been extended through to September 2021, with employees receiving 80% of pay for time furloughed. The full 80% will be paid to the employer by the government up to 30th June. For July, they will receive 70% and then 60% for August and September while topping up the employees salary to the 80%.

In addition, the employer will continue to pay employers NI and workplace pension contributions.

We are continuing to calculate these claims for our payroll clients so do get in touch if you are having any difficulty with this, or simply can’t face continuing through to September.

Self-Employment Income Support grants extended

There will be two further SEISS grants, for February to April and then a further grant for May onwards.

If you missed out on receiving the earlier grants due to being newly self-employed, provided a tax return was filed for 2019/20 you will now be able to claim these two grants.

The forth grant can be claimed from late April and will continue to be 80% of average profits capped at £2,500 per month. The fifth grant will cover the 5 months to September and will be linked to a reduction in business turnover. Self-employed individuals whose turnover has fallen by 30% or more will continue to receive the full grant worth 80% of three months’ average trading profits, capped at £2,500 a month. Those whose turnover has fallen by less than 30% will receive a 30% grant, capped at £950 a month. We are awaiting further details of this fifth grant.

Restart Grants & Rates Holiday extension

For businesses required to close, there are restart grants available from local councils.

The Chancellor told MPs: ‘Non-essential retail businesses will open first, so they’ll receive grants of up to £6,000 per premises. ‘Hospitality and leisure businesses, including personal care and gyms, will open later, or be more impacted by restrictions when they do, so we’ll give them grants of up to £18,000.

It looks like these will be distributed by local councils so you should keep checking their websites for more information, hopefully these will be distributed automatically if you have received previous grants.

There is also an extension to the business rates holiday so if you are eligible for this you will continue to pay no rates up to the end of June, with a reduction for the rest of the tax year.

Recovery Loan Scheme

The government have already announced a longer repayment period for “Bounce-back” and CBIL loans. From 6 April 2021 a new Recovery Loan Scheme will provide lenders with a guarantee of 80% on eligible loans between £25,000 and £10 million to give them confidence in continuing to provide finance to UK businesses. The scheme will be open to all businesses, including those who have already received support under the existing COVID-19 guaranteed loan schemes.

VAT Deferral Extension

If you deferred your VAT last year, you need to pay this before 31st March 2021.

You can arrange to set up a payment plan to pay this over up to 11 equal instalments starting in March. You have until 30th June to set up a plan but the instalments will be reduced so that the full amount is still paid by the end of January.

Unfortunately we can’t set the scheme up for you, but you can do it online through your government gateway account using this link. It is actually very easy, and takes just a few clicks and a couple of minutes online.

There is no interest payable on the VAT outstanding, and as we are not yet out of the pandemic, it might be worth considering taking this option.

5% VAT for hospitality, accommodations and attractions

The reduced rate of 5% for hospitality, accommodations and attractions will continue until 30th September 2021 and will then go up to 12.5% before returning to 20% on the 1st April 2022.

Stamp Duty Holiday

The holiday for Stamp Duty Land Tax (SDLT) has been extended to 30th June to allow for time to complete on the housing transactions. This will be a welcome relief as conveyancing bottlenecks may well have affected some people’s ability to access this relief.

Property purchases under £250,000 will also benefit from paying no SDLT until 30th September 2021.

Wider Tax Implications

Corporation Tax Increase

Corporation tax is set to rise to 25% from April 2023. Obviously this is disappointing for businesses who will see a big hike in their corporation tax bills. The smallest businesses will have a lower rate of tax but the threshold is only £50,000.

Many of our family businesses earn enough profit to support their household, so often have profits over this amount but I’m sure would not consider themselves to be large businesses. We have seen small company tax rates in the past, but the definition of a small company previously was one with much higher profits. This could have an impact on remuneration planning for some companies and raise the question again of ‘salary vs dividends’ so we will be paying very close attention to the impact of this measure in advance of the increase coming in.

Super Deduction

This measure does come in straight away, from 1st April 2021 to 31st March 2023, and is great news for companies who are investing.

When you spend money in your business, it reduces the profit and therefore the tax. So at current rates, you save 19% tax on the cost, so for every £1 you spend, your tax bill comes down by 19p.

With this Super Deduction, when you spend money on plant and machinery, you get more than the cost deducted against your profit, 130% of the cost, so it reduces your tax bill by more. This means that for every £1 you spend on, for example, computer equipment or machinery for your company, your tax bill is reduced by 25p. This significantly reduces the cost of any large expenditure, and the hope is this will encourage companies to spend some of their cash reserves over the next two years.

Income Tax Freeze

The chancellor has put a freeze on income tax rates through to 2026, which means in real terms you will receive less money after tax as your income increases through inflation.

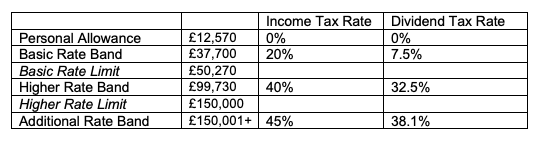

The income tax rates for 2021-22 are as follows:

VAT Threshold

The VAT threshold remains at £85,000 and will do until the end of 2024. This is effectively an decrease in real terms and this limit has been reducing for some time as the government seeks to bring more businesses into the VAT regime.

Capital Taxes

There were no changes at all to capital taxes in the budget this time. Although the rates for CGT annual exemption, pension limit and IHT rates remaining the same is effectively a decrease in allowances.

No changes to BADR what used to be known as Entrepreneurs relief.

It is widely expected that capital taxes will increase, in part due to the conservative governments pledge not to raise income tax, national insurance or vat. We may be expecting an autumn budget when we have a better idea of how well we have come out of the pandemic.