One of the most exciting things about being a business owner is seeing your ideas come to life. You get to use your mind every single day to solve, create, challenge, and inspire. And it’s truly invigorating. But it’s also something many of us take for granted.

Have you ever considered what would happen if, one day, your mind deserts you? Or if you were mentally incapacitated by illness or accident? What would happen to your business then?

Who will step up and authorise payments; deal with suppliers; sign cheques; or pay your staff? You might assume it’ll be a colleague or a family member, but that would be a risky assumption to make.

You need something more concrete in place to protect your business.

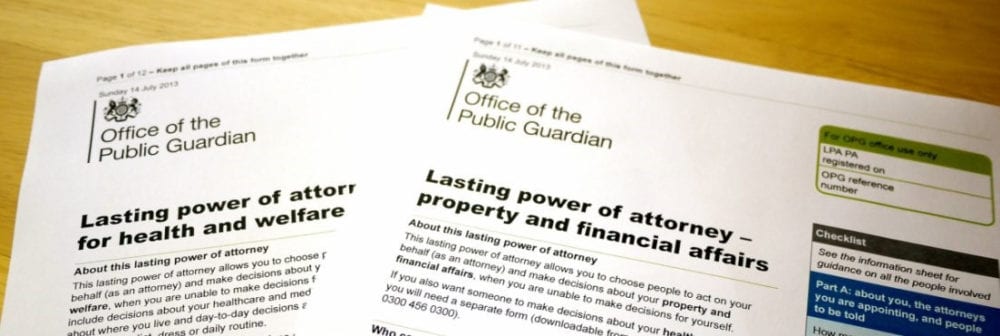

You need a Property and Financial Affairs – Lasting Power of Attorney (LPA).

What is an LPA?

An LPA is a legal document which lets you (the donor) appoint trusted people (the attorneys) to make decisions on your behalf during your lifetime.

There are two types of LPA, the first type is a Health and Welfare LPA which concerns all decisions in relation to your medical treatment or welfare arrangements.

The second is a Property and Financial Affairs LPA. You can set this up to be used on your behalf as soon as it is registered, not just if you lose capacity. This can be useful in a great number of circumstances where you may have problems managing your affairs, such as being out of the country on an extended holiday.

But if the worst should happen, it could be the difference between your business surviving and continuing, or collapsing in on itself should you lose capacity.

Without it, you’re essentially leaving your business and personal affairs in the hands of the courts – a long and expensive process, and one that could outlast your business and leave your staff and loved ones without a source of income.

Why do I need one?

For companies and partnerships with multiple directors and bank signatories, an LPA may not be critical. However, if a sole trader or sole director loses mental capacity, their business will almost certainly have to close as there will not be anyone with the authority to step in and run it.

So, consider it a duty of care to your business and its staff, shareholders and key stakeholders.

When should I put my LPA in place?

Now.

We always tell people to do these sorts of things, right now. Put your LPA in place when it’s not needed and doesn’t feel important or urgent. It will be so much easier, and you’ll be able to make cool headed decisions without it being an overly emotional process. Too often people wait until it’s needed and then sadly, run out of time.

The benefits of arranging an LPA while you’re still healthy means:

- You can choose who you wish to manage your business should you become temporarily or permanently incapacitated.

- Your staff and stakeholders have peace of mind that the business will continue in your absence.

- Your loved ones have peace of mind that your business affairs are in order.

You never know when illness or accident will strike, so it’s crucial that you’re prepared. A Business LPA helps you cover all the bases as you recover.

If you’d like to discuss arranging your LPA, we can help get you started. We find that this important element is often part of a bigger discussion, to include your plans for the future of your business, your wills and estate planning so we’ll help you talk through your choices before assisting you with the next steps.

Contact us today to speak with one of our friendly team members.