Investing in property is seen by many as a good investment for the long and short term, either renovating and selling properties on for profit, or owning them for the investment potential and receiving rental income every year.

Unfortunately for landlords, changes have been introduced over the last few years which have made it less tax-efficient to own properties and rent them out.

There is now an additional 5% stamp duty surcharge on all second purchases of residential properties and a significant restriction of mortgage interest relief (often referred to as Schedule 24).

These changes have led to lots of questions from our clients about whether a property should be owned by a limited company or purchased in their own name. We’ve set out the key information and main benefits to either option below.

Some of this can feel like complicated stuff, so if there’s anything here you need further clarification on – please do stop at any point and ask us.

Anyone buying a property to rent out or renovate will pay the additional Stamp Duty

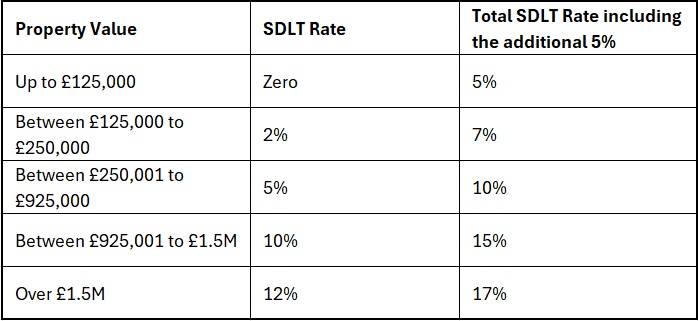

Stamp Duty Land Tax (SDLT) is payable on the purchase price of the property and is paid on all residential properties. An additional 5% surcharge is payable where the property is not your only home. For the 2025/26 tax year, the SDLT rates are as follows:

This means that anyone buying a property to rent out or renovate will pay this extra amount.

Whether you should use a limited company depends on your plans

‘Should I use a limited company? is one of the trickiest questions we get from clients, because the answer is often ‘it depends’. There isn’t a clear tax advantage for one way or the other, and it’s also one of those where a crystal ball would be ever so handy!

For most people, the answer is this:

If you are going to own the property as a long term investment then go for a limited company. If any of the following also apply, then a limited company becomes even more attractive:

- You have family members who you would like to share the income with or pass on the properties in the future.

- You intend to borrow money to purchase the properties.

- You have other income coming in which uses up your basic rate tax band (basic rate tax threshold for 2025/26: £37,700).

- You would like to retain some money in the company each year because you don’t need it to live on.

Buying property through a Family Investment Company means you can split the income between several family members

A family investment company is a company set up to hold the properties where the ownership of the company can be divided amongst the family. If you set up a structure like this to purchase your properties you are able to take advantage of splitting the income between several members of the family in a proportion that suits your requirements.

This structure can also be used to mitigate Inheritance Tax in the future by transferring over small numbers of shares each year and using your capital gains allowance so no tax is payable.

When you calculate your rental profits, do not deduct mortgage interest

A few years ago the government introduced new rules to restrict the amount of mortgage interest you could claim against your rental profits. These rules have become known as section 24. They have been fully in place since 2020/21.

When you calculate your rental profits (rental income less costs) you do not deduct any mortgage interest.

- Your rental profits add together with all other income to determine your total income, to assess how much of that income falls into a higher rate (2025/26 higher rate threshold: £37,701 to £125,140).

- You can then apply a mortgage reducer to your rental profits of 20% of your mortgage interest.

However, the change in calculation can make you a higher rate taxpayer where before you only paid basic rate tax. If you are a higher rate taxpayer with significant mortgage interest costs, this could increase the tax payable on your rental profits significantly. Also, you can lose your child benefits if you become a higher rate taxpayer.

Limited companies are not affected by section 24. They only pay tax on the profit after full deduction of the mortgage interest.

This has led to many property investors looking to transfer their portfolio over to the limited company but transfer of properties is difficult. The main barriers are:

- Transfer of buy-to-let mortgage. Many buy-to-let portfolios are on interest-only mortgages, so in many cases this is not a viable option.

- Stamp Duty and conveyancing costs of the transfer of properties.

- Capital Gains tax due on the sale of the property. For 2025/26, the annual CGT allowance has been reduced to £3,000 per person (or £6,000 for jointly owned properties).

Bear in mind also, that there are no guarantees that section 24 will not be extended to limited companies.

It is possible to incorporate your property business

It is possible to incorporate your property business if you work 20 hours or more per week on managing your property portfolio. Usually this would apply to a larger portfolio where no agent was involved.

Your limited company can make pension contributions for you

If you were wanting to retain your rental profits rather than spend them, you could invest these savings in your pension while saving tax and protecting your income in a pension scheme.

Your limited company can make pension contributions for you up to the maximum contribution of £60,000 for the 2025/26 tax year. The contribution is a deductible expense and reduces your corporation tax by 25% in the year of payment (corporation tax is now 25% for profits over £250,000).

Please note, if you earn over £150,000 per year or have already drawn down your pension, the contribution amount may be restricted. We recommend having a Financial Advisor assist you with calculating this amount. We’re here to support you if you need our help.

There are benefits to holding a property personally

When you sell an asset personally, you are subject to capital gains tax (CGT). For 2025/26:

- Basic rate taxpayers pay 18% on residential property gains.

- Higher rate taxpayers pay 28% on residential property gains.

Every year you get a CGT allowance of £3,000. If you sell a jointly owned property, each person gets the allowance, so the first £6,000 in profits would be tax-free. This can significantly reduce the amount of tax you pay or even make it tax-free.

There is no obvious ‘right answer’, just many factors to consider

Hopefully you can see now, why this is a tricky question for us to answer. There are many factors to consider for each individual and no obvious right answer.

The best way to make this decision is to talk through the above points with us so we can help you to come to a conclusion which gives you the best result.