Recently, some of our team traveled to London to attend a conference organised by accounting software Xero. Past attendees have referred to Xerocon as the ‘Glastonbury for Accountants’, and it certainly lived up to the hype.

Xerocon isn’t your traditional accounting conference. With inspiring keynote speakers, action focused breakout sessions, a guest appearance from a real life Astronaut, and a party that gets more outrageous every year, it’s the place to be for accountants who love Xero as much as we do and want to make a real difference in their clients lives.

The part that excites us most on behalf of our clients is being able to learn about upcoming features in Xero and new apps that will enable our clients to work more efficiently when it comes to keeping track of their numbers.

Here are some of the new releases that will most benefit you:

- Pay with Transferwise

Next year, a new bill payment solution will be launched which will enable clients to pay and manage their bills on Xero more efficiently. Xero have teamed up with Transferwise to allow you to pay bills using your preferred existing bank account in just a few clicks and it saves time when processing invoices and prevents paying suppliers in two different systems.

What is your preferred bank account?

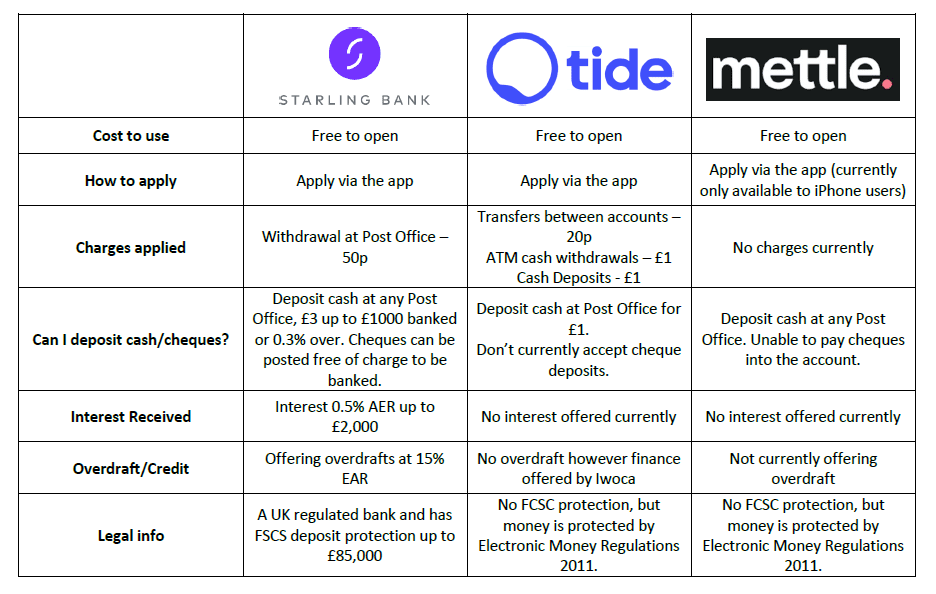

This year there was a lot of talk about the rise of online banks. With high street banks slowly dwindling (especially in smaller towns) clients are looking to online banks to provide them with the same services at a fraction of the cost.

Natwest has just launched its own online bank Mettle, with Starling and Tide offering similar services. These banking options are becoming more and more popular with clients who don’t require face to face contact with their bank.

We’ve put together a comparison of Mettle, Starling and Tide to help you decide if one of these options is for you:

- Xero Expenses

Clients who are using Xero expenses from December 2019 will be able to calculate mileage and submit on the go using the app in one click, saving time and preventing errors. Users will also have the ability to submit expense claims on behalf of their colleagues via the app.

- Business Snapshot

Xero will be piloting a new feature that allows us to improve the way we provide our clients with real-time insights. The Business Snapshot will summarise income, expenses, gross and net profit, receivables and payable days, cash and balance sheet in one view on the Xero platform. This will make it even easier for you to see how your business is performing, and will allow us to easily flag potential concerns and opportunities.

- Short-term cash flow tool

Xero are introducing a short-term cash flow tool to give small business clients a 30-day view of their business health. This will enable you to make decisions on payments and bills based on the potential impacts on your cash flow.

When will these be available to you?

Many of these features won’t be available completely until 2020, but if you would like to hear more about how they could help your business, we’d love to hear from you. As the Xero onboarding specialist, I am looking forward to helping our clients achieve an even more streamlined accounts process with the help of these new features!